.png)

Easy regulation Process

Check Eligibility

Buy Subscription

Upload Documents

Bank Verification

Loan Sanction

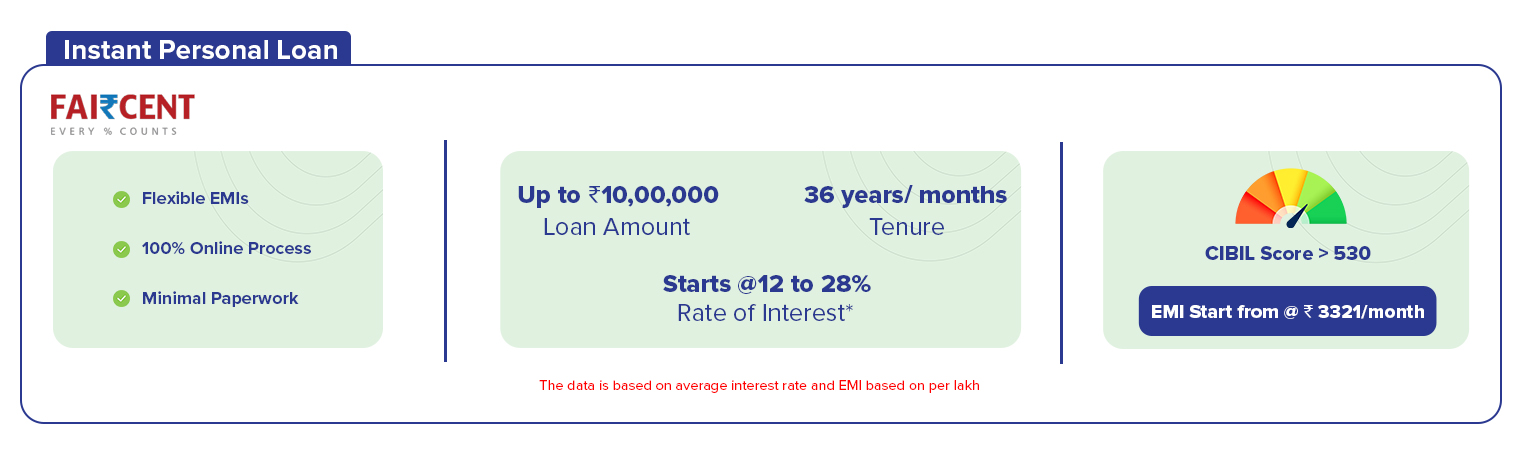

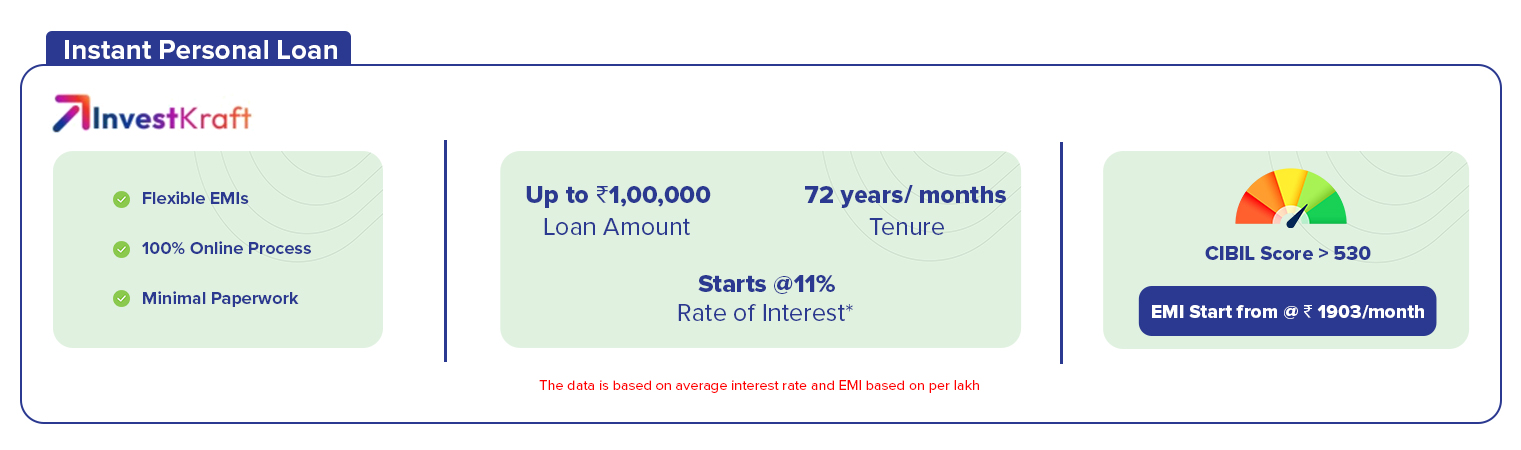

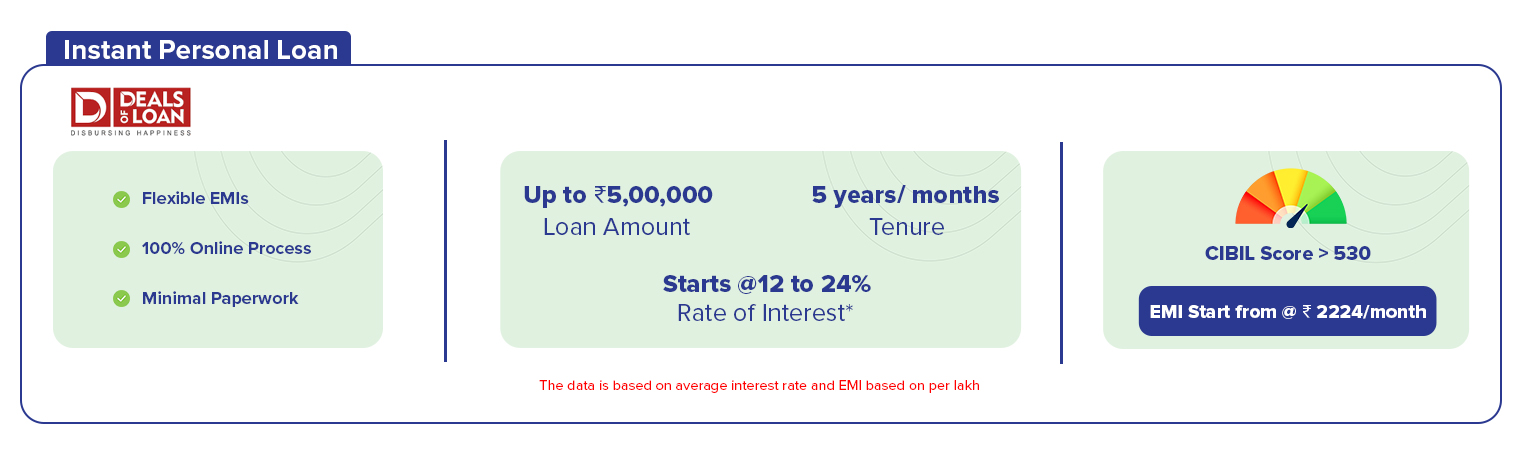

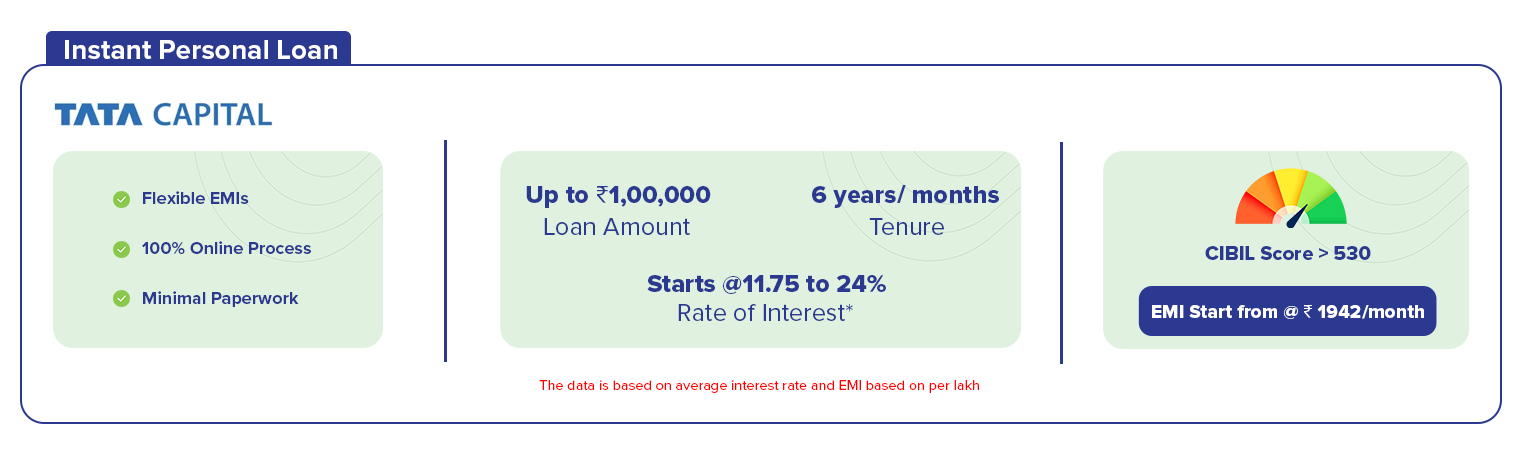

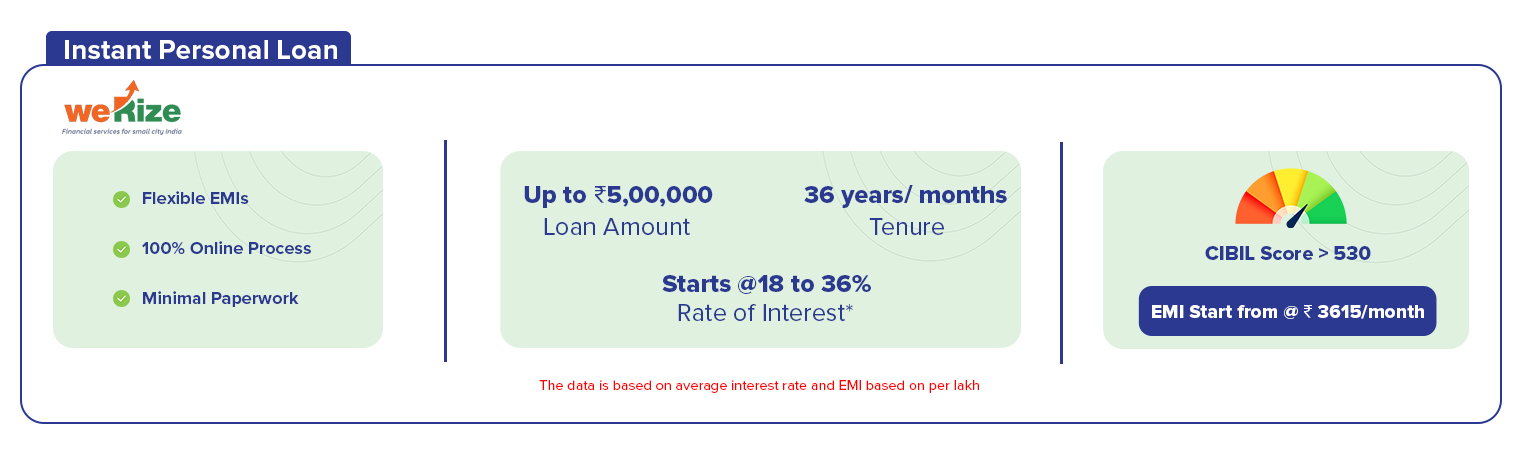

Disclosures: The Loan Tenure ranges from minimum 6 months to maximum of 60 months, with annual interest rates starting at 11% and goes up to 34%. A processing fee up to 2% may be applicable. Representative Example: If a loan of ₹1,00,000 is availed at an interest rate of 12.5% per annum for a tenure of 12 months, and a processing fee of 2% is applied: Interest Payable: ₹6,720 approx. Processing Fee: ₹2,000. Total Loan Cost (including interest + fee): ₹1,08,720. APR (Annual Percentage Rate): 14.27% approx. *T&C Apply. All figures are indicative and may vary based on customer profile and final approval by NBFCs or financial partners.

Disclaimer : We are a consultancy firm. We do not guarantee loan sanction. All loans are subject to approval by NBFC partners.

2nd Floor, Plot 29, Parvati, Nagar Chs 2, Sy. No.123/1, Katargam, Surat- 395004, Gujarat | +91-99798-74245 | info@kreditindia.in

CIN : U66190GJ2023PTC145985 | Time : 10AM to 5PM (Monday to Saturday)